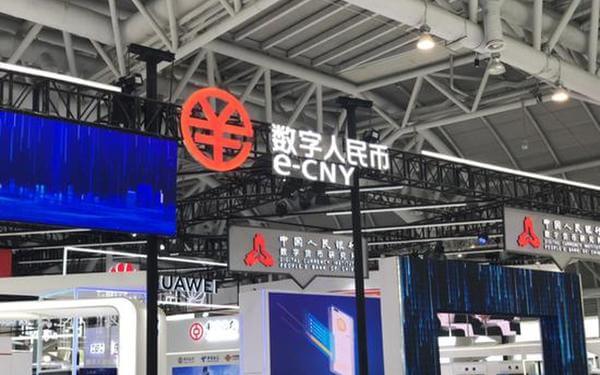

- e-CNY is attracting more and more public attention. At the 4th Digital China Construction Summit, the e-CNY booth was crowded with people, and the enthusiasm and interest of ordinary people in e-CNY was high. The bank is also pushing more merchants and individual users to download digital wallets so that they can directly use e-CNY for transactions in the pilot program.

The central bank official recently stated that the current e-CNY pilot scope has been expanded in an orderly manner, the application scenarios have been gradually enriched, the application model has continued to innovate, and the system operation has been generally stable, which initially verified the feasibility and reliability of the e-CNY in theoretical policies, technology and business .

In order to promote the public’s understanding and acceptance of e-CNY, the central bank is expected to issue free digital cash red envelopes to Shanghai residents during the upcoming “May 1st” period.

e-CNY can be applied to multiple scenarios. At this Digital China Construction Summit, Bank of China exhibited for the first time a foreign currency-convertible e-CNY prototype, which can support the exchange of 17 currencies, including the renminbi. In the future, foreigners holding passports only need to put foreign currency into the machine, and the machine will automatically spit out an e-CNY card. The card also has a display screen showing the transaction amount and available balance. Chip wallet”.

With this wallet, foreigners can spend on terminals that accept e-CNY payments. The application scenarios cover shopping malls, supermarkets, vending machines, transportation, education, medical care, farmer’s markets, etc., and will be available for the first time. It will be officially put into use at the Winter Olympics next year.

The on-site staff introduced to the CBN reporter that the visual chip wallet is divided into two categories: online and offline. The data in the wallet that supports online functions is connected to the network, even if it is lost, the data is still stored in the corresponding service provider system; while the offline wallet is similar to the current transportation card without network support, and is also called a “hard wallet” “.

The visitors were very interested in this e-CNY exchange machine. A visitor who rushed to Fuzhou from Xiamen said to a reporter from China Business News: “We hope that e-CNY will be launched in various places as soon as possible. For example, at the port of Xiamen, such exchange machines are needed so that the people can also enjoy the numbers. The benefits of currency.”

At the end of 2019, e-CNY pilots and tests have been launched in Shenzhen, Suzhou, Xiongan, Chengdu and the Beijing Winter Olympics. By October 2020, six e-CNY projects have been added, including Shanghai, Hainan, Changsha, Xi’an, Qingdao, and Dalian. The pilot test area has initially formed a “10+1” pattern.

Take the lead in promoting domestic individual consumers

A person from the central bank told CBN reporters at the booth that e-CNY has become another official currency issued by the central bank after banknotes and coins, and will be part of the tangible currency (M0) issued by the central bank. Specifically, the central bank issues digital currency to banks, which then transfer the currency to individuals and companies.

However, the current e-CNY pilot is only open to specific invited people, and it is hoped that the promotion and popularization can be accelerated in the future. “This is an approach that conforms to the global trend. It is shown to the public at this exhibition, and it is also hoped to help ordinary people understand what e-CNY is and how to use it.” He said.

However, he also emphasized that the central bank launched e-CNY not to compete with Alipay or WeChat Pay. Its role is more like a “backup” or “redundancy.” Currently, Alipay and WeChat Pay control about 94% of the online payment market in China. The e-CNY wallet that is still in beta can be bundled with more than a dozen software applications including Meituan, JD.com, Didi Chuxing and Bilibili, but it cannot be connected to WeChat or Alipay.

The sovereign digital currency developed by China is far ahead of similar initiatives by other major economies. CBN reporters saw at the exhibition hall that in addition to the six state-owned banks of China, Agriculture, Industry, Construction, and Communications, but also technology companies such as JD.com, Ant Financial, Huawei and Tencent have participated in the e-CNY The development and standardization of research and development work, and promote the pilot work in accordance with the overall arrangement of the central bank.

Li Bo, deputy governor of the central bank, said last week that the current focus of renminbi digitization is to promote its domestic use. He said he hopes that e-CNY will be used for cross-border payments in China. Some analysts believe that this will enhance the global status of the renminbi and ultimately break the dominance of the dollar settlement system.

HSBC expects that e-CNY will be rapidly popularized in China. HSBC wrote in a recent report: “The usability of e-CNY is comparable to Alipay and WeChat Pay, but its security features may be higher, and the technical content is comparable to Bitcoin.”

PricewaterhouseCoopers (China) Global TMT leader Zhou Weiran said that e-CNY will digitize the “last mile” of consumption, enabling banks and merchants to capture consumer behavior data and gain insight into consumer spending patterns. But he predicts that the mass adoption of e-CNY will not happen overnight. “In the next few years, e-CNY will coexist with Alipay and WeChat Pay, accounting for up to 10% of China’s electronic payment market,” he said.

“The digital currency using the blockchain technology encryption system is expected to enable banks and governments to accurately track the flow of funds, and help detect and prevent money laundering activities.” Zhou Weiran told a reporter from China Business News, “All future inter-bank customs clearance Electronic guarantees can be used for both payment and payment, which will eliminate intermediary clearing agents, shorten clearing time, and reduce transaction costs.”

He believes that the government’s strategy of focusing e-CNY on the development of individual consumers is very correct, and once the digital currency is widely accepted by the public, it will establish a systematic foundation and push it to the corporate level in the future. Will have a huge economic impact. He also told a reporter from China Business News: “In the future, third-party mobile wallet operators will work closely with the central bank to embrace the development trend of digital currency.”